Independent Sector has more than three decades of experience in advocating on behalf of the charitable community. We know that changes in tax policies have direct and indirect effects on Americans’ charitable contributions to all types of 501(c)(3) nonprofit organizations, from places of worship to local foodbanks. As the White House and Congress consider new tax policies to stimulate economic growth, there has been and will continue to be significant debate about the potential impact of proposed tax changes on charitable giving. An important question is whether changes in tax policy could encourage more people—specifically, people who do not currently have access to the charitable deduction—to give more.

Independent Sector believes there is opportunity in tax reform to expand access to the charitable deduction to 100 percent of taxpayers. Since 1917, the U.S. tax code has encouraged charity by allowing taxpayers to write off their gifts. Currently the charitable deduction is only available to those who itemize on their taxes – about 30 percent of taxpayers – and “itemizers” are usually those with higher incomes. Independent Sector research conducted by the Indiana University Lilly Family School of Philanthropy examines how tax proposals and the expansion of the charitable deduction would affect charitable giving. Our aim is to provide charitable organizations and policymakers with data they can use to make sound decisions on what best strengthens American communities.

Most recently, the White House unveiled a preliminary outline of their tax reform plan, which closely mirrors the 2014 Tax Reform Act by then-House Ways and Means Committee Chairman Dave Camp (R-MI). The new study uses the Camp proposal in addition to data from the University of Michigan’s Panel Study of Income Dynamics, the Philanthropy Panel Study created by the Lilly Family School of Philanthropy, and the 2009 IRS Statistics of Income Public Use File.

The study answers the following questions:

- What are the estimated effects of potential tax policy changes on charitable giving?

- What is the effect on charitable giving in tax reform if the charitable tax deduction is expanded to non-itemizers, in addition to itemizers?

- How do the proposed tax policy changes affect taxpayers’ charitable giving across income levels and by charitable subsector (religious versus non-religious)?

- What are the effects of these policy changes on tax revenue collected by the U.S. Treasury?

Here’s what the research found:

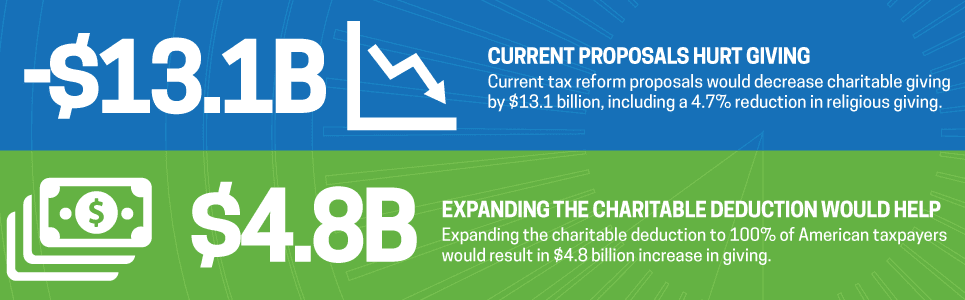

- Current tax reform proposals would significantly decrease charitable giving.

The current proposals, which include an increase in the standard deduction and a decrease in the top marginal tax rate, would decrease charitable giving, including giving to religious institutions, by as much as $13.1 billion a year. (4.6 percent). - Expanding the charitable deduction increases charitable giving.

Expanding the charitable deduction to non-itemizers erases that $13.1 billion deficit caused by other tax proposals and produces a net gain in total giving of up to $4.8 billion a year. - Tax incentives affect giving to religious organizations as well as other charities.

Current tax reform proposals would reduce charitable giving to religious organizations by as much as 4.7 percent and giving to other types of charitable organizations by as much as 4.4 percent.

Our tax code should incentivize all Americans to give in support of their communities. The charitable community has a long and unique history of being the sector where people come together to solve problems, improve their communities, care for the most vulnerable, and enrich our hearts, souls, and minds. Our tax code should reflect these values by encouraging all people to give more to the organizations and causes that collectively build stronger communities. Independent Sector encourages all individuals and organizations to use this study to help make that case.